The best architecture enhances how people live, work and play, and it responds to the changing needs of a community. At Prosper our architectural design portfolio is broad. Our clients choose us based on our expertise, but also because of the time we invest to understand who the space is for and how it can enrich their lives.

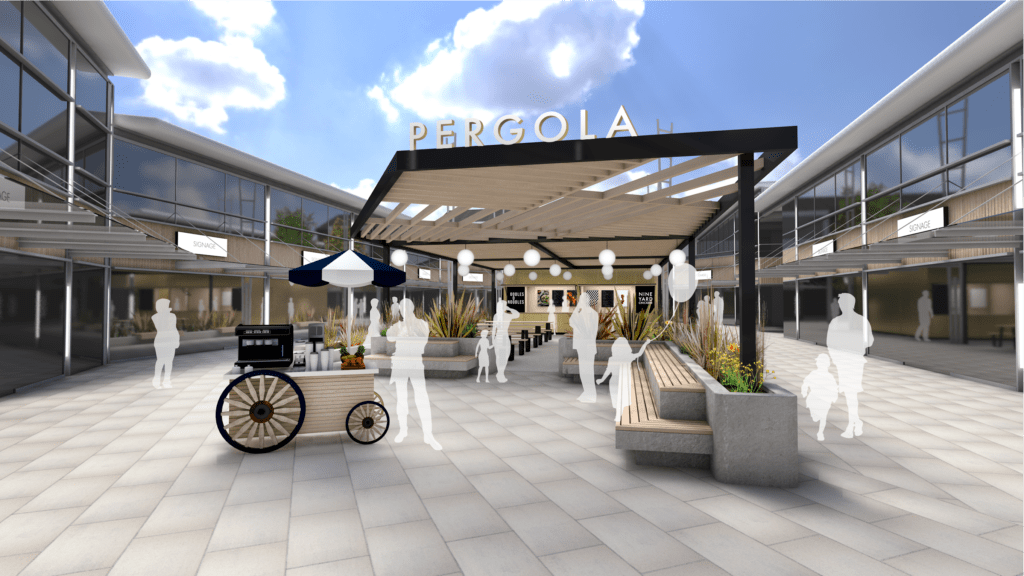

We’re looking to the future and designing to realise the potential of our high streets and public realm by combining appropriate mixed-use development of commercial spaces with community initiatives that encourage footfall.

Retail & Leisure Architecture

Building prosperous spaces

The devolution of the high street, and the need to attract footfall in an increasingly difficult climate present complex challenges demanding creative solutions.

At Prosper our retail specialists create architecture that works, considering tomorrow’s needs as well as today’s. Commercial success and humanised spaces are inherently linked and we understand what retailers need to thrive. Whether the brief is to build a new scheme or to rejuvenate an existing centre, our focus is to optimise asset value by designing compelling solutions that pull in footfall. Places where people will choose to spend their time and money.

If you’re looking for interior fit-out and international roll-out services you’ll be safe in the hands of our specialist team. Well versed in translating interior concepts into site specific solutions, we’ve been delivering retail environments for over 25 years and have the technical know how and practical experience to value engineer a concept. At every stage Prosper provides great value for our clients whilst maintaining the concept integrity for their consumers.

Public Realm

The fabric of society

Prosper’s proven credentials in public realm architecture are built on visionary design principles. We design for people, for participation, for health and for happiness, sharing our insights into what works now, and what will work in the future. Our approach combines human behaviour, trend analysis and sustainable design ethics, proudly delivering schemes that surpass expectations.

Residential Architecture

Putting home at the heart of design

Exceptional residential architecture marries the design of aspirational spaces with the creation of community solutions that enhance local housing options.

Regardless of the scope of the project, we work collaboratively with our clients to understand their aspirations, focusing on the potential of the space before challenging ourselves to design a solution of exceptional quality.

For bespoke projects we will invest time understanding your aspirations to build a picture of how you like to live. Then we work to bring your vision to life, creating a home that facilitates your lifestyle whilst adopting sustainable design practices for minimised environmental impact.

We’ll never adopt a design by numbers approach. We prefer to offer bespoke responses which are grounded in locality and seek to enhance the landscape. Whilst we’re ever mindful of budgetary constraints on development projects, we design with homeowners in mind, maximising the commercial potential of sites without compromising standards.